Nobody’s calling you a hypocrite - at least I’m not anyway. It’s just that the irony of the situation is funny. The way your post was worded made it look a bit like an investment property and not a primary residence.

The Decline of Vancouver.

Posted by: syncro

Nobody’s calling you a hypocrite - at least I’m not anyway. It’s just that the irony of the situation is funny. The way your post was worded made it look a bit like an investment property and not a primary residence.

It's not that funny.

"OH you don't like capitalism but I see you have a job and possessions! How do you explain this? I'm so smart!

Posted by: Fast-Orange

It's not that funny.

Now you’re just being hurtful.

Posted by: PaulB

Posted by: [email protected]

I'd like to see short-term rental permit system that limits the number of short term rentals per owner and per building, maybe even per area.

At the building level, many stratas limit the number of units that can be rented, and many ban short-term rentals. Of course, enforcement is a challenge, and often comes down to neighbours ratting someone out to the strata board when they realize there is a steady stream of strangers coming and going.

I was more thinking about government level regulation. Strata decision making could easily be influenced if enough units in a building get bought up by investors who want to use them for short term rentals. The building where my parents stayed in May was effectively a hotel, they barely saw anyone who looked like a normal resident but saw lots of people with suitcases coming and going. At least 6 (probably more) listings in that building from the same Airbnb host I linked to in my previous post.

I like the concept of Airbnb and have used them a lot (as a guest) but I think there should be a healthy ratio of short term vs long term rentals.

tashi deleted his post but he made an important comment about not being underwater on a property purchase.

Right now would be an absolutely terrible time for a first time buyer to get into the market as the chances of going underwater are very high. With interest rate rises and prices in a lot of areas not having moved much yet it's gotten even more expensive to buy a home. On the other end of things some SFH neighbourhoods have seen losses of $400K or more in just a few months.

It not a question of prices dropping at this point, it's a question of how far down will things go and conservative estimates are 20-25%. Some areas have seen close to that already - hang on to your hats, it's going to be a bumpy ride.

Posted by: syncro

It not a question of prices dropping at this point, it's a question of how far down will things go and conservative estimates are 20-25%. Some areas have seen close to that already - hang on to your hats, it's going to be a bumpy ride.

That is a "conservative estimate". I am not saying it won't happen, but that seems like the extreme end of what people are predicting. Personally, I don't think anyone has a decent crystal ball for this new crisis and we won't have a good idea until some time in 2023. If you read the various reports there is zero consistency on anything. Oil could go through the roof or tank. high inflation might be over by Christmas or maybe it will go on for years. And so on.

Extreme end is more like 40-50%.

Which is still unaffordable lol

Posted by: Adam-West

Which is still unaffordable lol

Yup, that's what makes this all so crazy. Prices of SFH's would need to drop around 70% to become affordable for the average family in the MV region.

For the time being, unless you've been in the market for a while already or have wealth (generational or otherwise) on top of good income buying a home, particularly a SFH, is not happening for many people.

https://vancouversun.com/news/local-news/vancouver-third-least-affordable-city-demographia

http://www.demographia.com/dhi.pdf

If you want a house is a bigger city, Calgary is your best bet in Canada it would seem.

Last edited by: syncro on Aug. 4, 2022, 12:23 p.m., edited 1 time in total.

Source for those 'conservative' and 'extreme' pricing drop forecasts?

I don't see the scenario where 40-50% happens. Would be interested in reading the rationalization for it. Or are those estimates for # of sales (transactions)?

https://globalnews.ca/news/9034088/home-sales-prices-metro-vancouver-fraser-valley-decrease/

Looks like YoY prices are up, but Transactions have taken a big hit. MoM prices are slightly down.... so far. Also those links/stats are overall averages, I'm sure it's regionally variant in the GVRD and surrounding areas.

I do agree that this is the start of a falling market and there's going to be some pain. I just don't see how it price corrects by 40-50 points.

Last edited by: Couch_Surfer on Aug. 4, 2022, 1:13 p.m., edited 2 times in total.

YoY prices are up 10%, but the reality of 12 months ago is hugely different from the past 4 months - namely interest rates. We're already seeing 20% price drops in the past 4 months in Langley, Maple Ridge and beyond. Consider that prices are up 30%+ over the past two years on top of what's happened over the past ten and a 40-50% shouldn't seem impossible. We've had historic low interest rates for way too long and a bunch of other factors contributing to all of this. Even with the recent price cuts, the costs of home ownership are now higher due to rising interest rates. You also have factors like negative equity on some variable mortgages where people could have their mortgage principal increase due to the rise in rates. Sales have plummeted and if people need to sell then that is going to put significant downward pressure on prices. Then we have the economy to worry about - how strong is it going to be? What effects will the increased money supply and inflation have in the next year or two? In BC real estate and construction represents nearly 25% of our GDP, what happens to the rest of the economy when that takes a bit hit. And what about govt losing a significant portion of it's tax base when things dry up? Somewhere around 10% of our tax base comes from property taxes and property transfer taxes. Top that off with record levels of consumer debt, incl HELOC's, and the future does not look friendly. I've always said the demographics and increasing population will continue to put pressure on the housing supply, but there are signs we've hit the tipping point because the region is simply too expensive to live in - people are leaving and there is a shortage of workers, especially for lower paying jobs. It seems far too easy to forget about some of the less obvious factors in terms of just how much our economy relies on real estate.

We've ridden a large wave of real estate prosperity for close to 20 years now and it seems about ready to come crashing down. Hopefully not too many people are standing on the beach.

Edit - this article is 4 yrs old and was already talking about the economic dangers we were facing, and rising interest rates weren't really a factor back then.

Last edited by: syncro on Aug. 4, 2022, 2:09 p.m., edited 3 times in total.

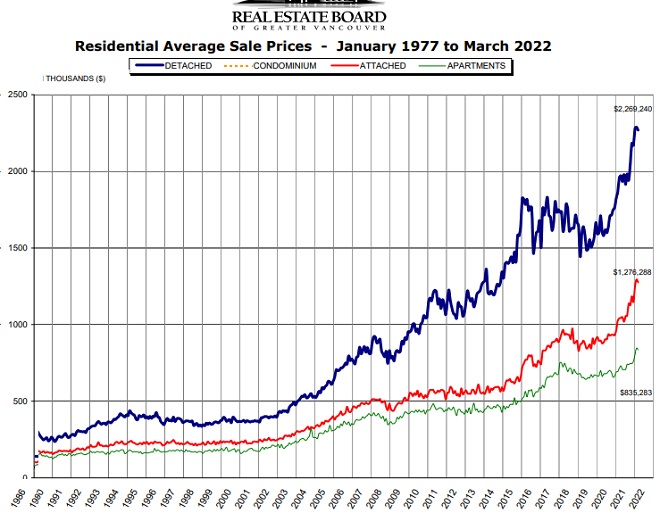

50% per that graph would get us back to 2011 pricing, I struggle to see that scenario. I think before we get there, a lot of inventory just pulls out of buy/sell and sits on sideline and a lot of people come in for 'discount' shopping. Seems from that graph, there is a bit of a price floor and trading range in the 1.5M - 1.75M range (sfh) from 2015-2020. The lower end of that range would be about a 30% price cut from the peak (from that graph).

Interest rates are rising yes. But they're rising off of 0% - rates are still quite cheap in the grand historical sense. Rates will get pricier before end of year though with 3 more potential rate hikes to come.

Last edited by: Couch_Surfer on Aug. 4, 2022, 3:07 p.m., edited 1 time in total.

Posted by: Couch_Surfer

50% per that graph would get us back to 2011 pricing, I struggle to see that scenario. I think before we get there, a lot of inventory just pulls out of buy/sell and sits on sideline and a lot of people come in for 'discount' shopping. Seems from that graph, there is a bit of a price floor and trading range in the 1.5M - 1.75M range (sfh) from 2015-2020. The lower end of that range would be about a 30% price cut from the peak (from that graph).

Interest rates are rising yes. But they're rising off of 0% - rates are still quite cheap in the grand historical sense. Rates will get pricier before end of year though with 3 more potential rate hikes to come.

Ultimately it's going to come down to what people can afford to buy. I've said in a few places that the one thing that really stands to throw a wrench into prices falling a lot is the transfer of generational wealth from boomers. It's already started happening but the pace is going to be increasing substantially over the next 5-10 years. That's a factor that could keep things stable. There' a lot to consider simply besides rising interest rates and personally I don't think a 50% cut will happen either, but I won't be surprised if it does. If I was to choose I think 30-35% down from the peak is realistic.

Edit - This link gives a good breakdown of all the categories over the past couple years.

Last edited by: syncro on Aug. 4, 2022, 3:38 p.m., edited 2 times in total.

It is interesting that now we are seeing prices drop nobody mentions foreign ownership anymore. If foreign ownership and laundered money were a big part of what got us into this how does that affect the market now?

And then there is this:

https://www.cbc.ca/news/business/real-estate-investment-firms-financialization-housing-1.6538087

Last edited by: chupacabra on Aug. 4, 2022, 3:43 p.m., edited 1 time in total.

Posted by: chupacabra

It is interesting that now we are seeing prices drop nobody mentions foreign ownership anymore. If foreign ownership and laundered money were a big part of what got us into this how does that affect the market now?

If enough of those people decide to get out in a hurry it could trigger a landslide. But if you consider that money is simply being parked here then anyone who bought more than 2 year ago probably won't care if things drop 20-35% as that will simply take them back to 2019 valuations. Then again, if they are buying with cash then the price drops could could help bring in more buyers. There is a significant enough lack of data that it makes factoring in foreign capital and money laundering a bit hard to nail down. That recent report put it fairly low at only around 5% of the mark iirc but it could easily be higher than that.

I just want Pedro to show up and jump back into this conversation.

Forum jump: