Posted by: heckler

RRSP is not something you ‘buy’. It is a type of income tax deferred account. If you currently ‘buy’ RRSPs from your bank teller, lets talk.

RRSP is also not something that you must wait till you're ‘forced’ to take out a high taxable income. Its a tool, when used properly, to reduce lifetime income tax.

i had 3 relatives working banks, anyone above a teller with an office has a quota's to sell you their products so the bank can take that money and lend it out to make money on the spread between deposits and money lent out, in return you get a tax deferral, if that isnt buying an RRSP I duno what is ?

I spent a lot of time working in all the banks, its a different perspective hanging out when you are not the customer, i might hit 2 or 3 different institutions in a day, it was always good to pick their brains, I asked a couple of guys about mortgages and they said do this and it turned out to be good advice

Another time I forget the philosophical discussion but the punch line was " we are all just selling the same 250-300 products " So buddy the bank officer sure thot he was selling bank products and so he was telling me the 6 big banks were all just selling the same stuff

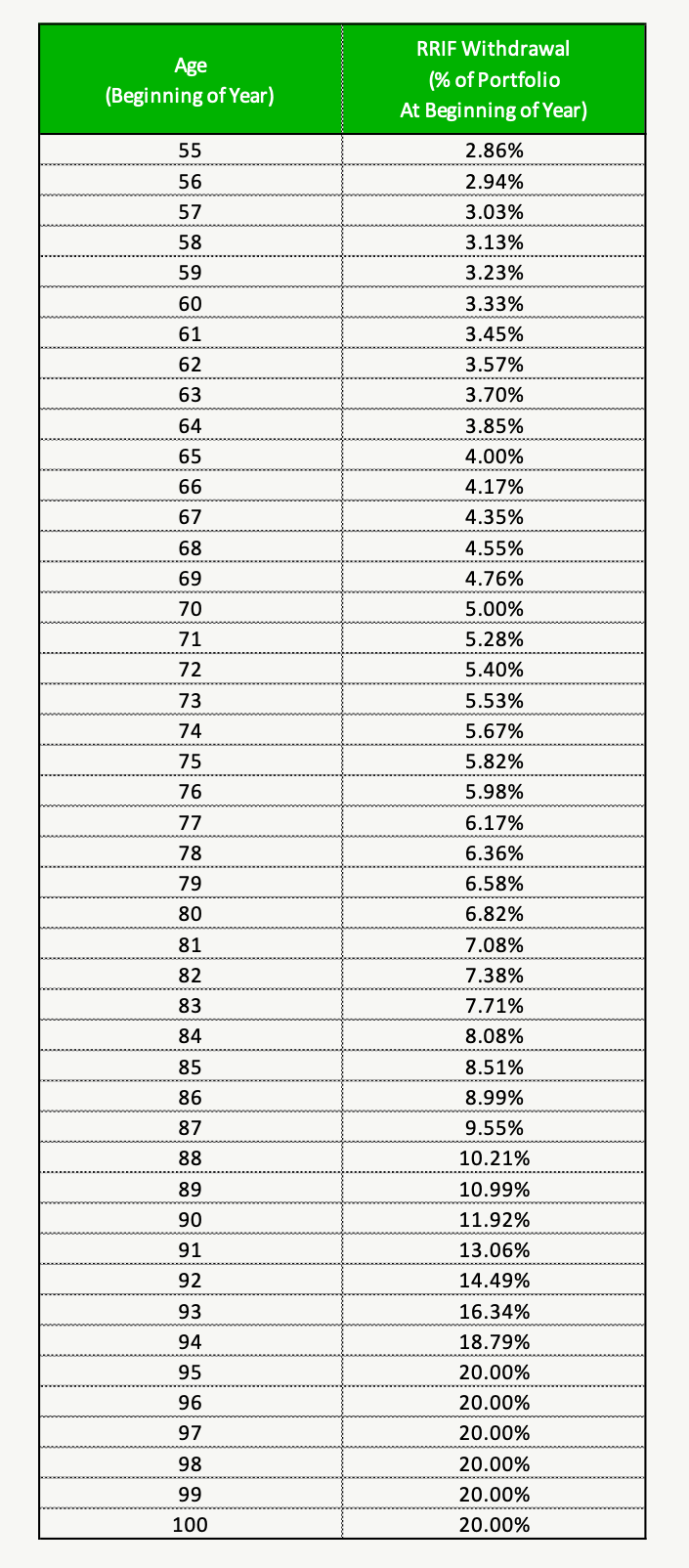

I am pretty sure you must RIF an RRSP before age 71